- The index loses the grip and drops to 106.30.

- US yields resume the upside amidst alternating risk trends.

- Initial Claims, Balance of Trade next of note in the NA docket.

The greenback, in terms of the US Dollar Index (DXY), keeps trading within a cautious stance around 106.30 against the backdrop of improving US yields and alternating risk appetite trends.

US Dollar Index looks to data, risk trends

The index trades with gains for the third session in a row amidst the generalized cautious tone among market participants, all against the backdrop of escalating tensions between US and China and recent hawkish messages from Fed speakers ahead of the key Nonfarm Payrolls due on Friday.

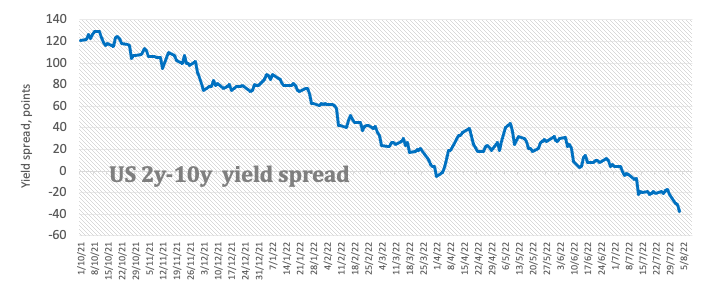

The deceleration of the rebound in the dollar also comes in line with the bounce in US yields across the curve, particularly in the short end and in response to recent hawkish comments from FOMC’s Daly, Bullard and Mester, who defended further tightening in the next months.

Back to the US docket, usual weekly Claims are due next along with trade balance figures.

What to look for around USD

Despite the risk aversion ebbed somewhat in past hours, the dollar remains bid vs. the risk complex and keeps the index underpinned in the mid-106.00s for the time being.

The very-near-term outlook for the dollar has deteriorated somewhat in recent sessions, particularly following the latest US GDP figures and the prospects for further tightening by the Fed in the next months, which carry the potential to drag further the economy into the contraction territory.

Among the positives for the buck still emerge the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Balance of Trade, Initial Claims (Thursday) – Non-Farm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.07% at 106.29 and faces the next support at 105.04 (monthly low August 2) seconded by 104.91 (55-day SMA) and finally 103.67 (weekly low June 27). On the upside, a break above 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002).